If the qualifying period is one year or less, the member shall forfeit an amount equal to: a) all dividends for 90 days on the amount withdrawn, or b) if a withdrawal reduces the balance below the required minimum, the account shall be closed and a loss of dividends as stated above, whichever is less, will be assessed on the entire amount in the account. We may impose a penalty if you withdraw principal from your account before the maturity date. This account is FDIC-insured, helps you save automatically, and integrates seamlessly with.

#M1 SAVINGS ACCOUNT PLUS#

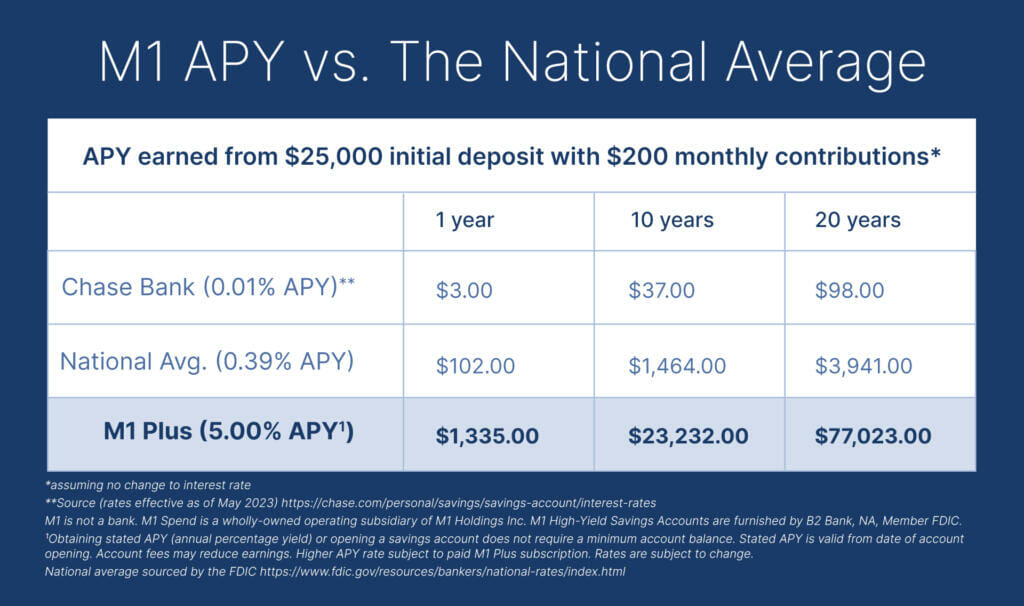

Dividends are paid on the last day of each quarter. Reach savings goals faster with 5.00 APY for M1 Plus members. Share certificate maturity dates vary as do minimum balance requirements. Our share certificates provide an excellent investment opportunity with an exciting advantage – the opportunity to lock in a higher dividend rate than a traditional Share Savings Account. For complete list of fees, visit M1 Fee Schedule.Modesto’s First FCU offers a variety of share certificates to suit your financial needs. Other fees may apply such as regulatory, M1 Plus membership, account closures and ADR fees. Brokerage products and services are offered by M1 Finance LLC, an SEC registered broker-dealer, Member FINRA / SIPC.Ĭommission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Nothing in this informational site is an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, or tax advisors.īrokerage products and services are not FDIC insured, no bank guarantee, and may lose value. Using M1 Borrow’s margin account can add to these risks, and you should review our margin account risk disclosure before borrowing. Past performance does not guarantee future performance. "M1" refers to M1 Holdings Inc., and its affiliates.Īll investing involves risk, including the risk of losing the money you invest. M1 Plus is a paid membership that confers benefits for products and services offered by M1 Finance LLC, M1 Spend LLC and M1 Digital LLC, each a separate, affiliated, and wholly-owned operating subsidiary of M1 Holdings Inc. "M1" refers to M1 Holdings Inc., and its wholly-owned, separate affiliates M1 Finance LLC, M1 Spend LLC, and M1 Digital LLC. M1 is a technology company offering a range of financial products and services. Deposit A Deposit refers to transferring money from your external bank into your M1 account. M1 relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Portfolios can have an aggregate total of 100 securities. All agreements are available in our Agreement Library.

#M1 SAVINGS ACCOUNT FULL#

Full terms of the Program can be found at m1.com/legal/agreements/HYSA_Agreement and a complete list of participating banks in the program can be found at m1.com/legal/agreements/depositnetworkīy using this website, you accept our Terms of Use and Privacy Policy and acknowledge receipt of all disclosures in our Disclosure Library. Deposits may be insured up to $5,000,000 through B2’s Insured Deposit Network Program. Additional FDIC insurance coverage is provided through B2’s Insured Deposit Network Program involving other FDIC insured depository institutions. Obtained from the FDIC.ģB2 Bank is a member FDIC institution and does not itself provide more than $250,000 of FDIC insurance per legal category of account ownership as described in FDIC regulations. The deposits are actually held by B2 Bank National Association, formerly. Rates are subject to change.ĢNational average is 0.39% APY as of April, 2023. M1 Finance has just introduced a new High Yield Savings account that pays 5.00 APY.

Higher APY rate subject to paid M1 Plus subscription. Stated APY is valid from date of account opening. ¹Obtaining stated APY (annual percentage yield) or opening a savings account does not require a minimum account balance.

M1 High-Yield Savings Accounts are furnished by B2 Bank, NA, Member FDIC. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc.

0 kommentar(er)

0 kommentar(er)